As a founder, your most valuable asset isn’t your product or your funding—it’s your time. The search for affordable accounting software for startups is really a search for a tool that gives you more time to focus on what truly matters: building your business. The right software automates financial busywork and delivers the clarity needed to make smart, confident decisions.

This guide is built from real-world experience to help you navigate the options without the jargon. We’ll dive into the best platforms, from free tools to scalable solutions, ensuring you find the perfect financial co-pilot for your startup’s journey. Let’s move your finances from a source of stress to a source of strength.

Table of Contents

Why Your Startup Needs More Than a Spreadsheet

Every startup’s financial story seems to begin in the same place: a spreadsheet. It’s free, familiar, and feels like enough. But as your business grows, that simple grid quickly becomes a liability. This is the point where investing in dedicated accounting software shifts from a luxury to a necessity for survival and growth.

This transition is less about bookkeeping and more about business intelligence. Proper software minimizes the risk of costly human errors that can jeopardize cash flow or create tax-season chaos. It provides a live, accurate pulse of your company’s financial health, empowering you to manage your runway, pivot intelligently, and speak with confidence to investors. For startups, adopting the right financial tool is a foundational step toward building a resilient, scalable, and ultimately successful enterprise.

A Personal Tale: Drowning in Data, Rescued by Software

I vividly recall the tipping point with my first business, a boutique e-commerce store. For the first year, we managed everything—sales, inventory, expenses—in a monstrously complex Excel file. Then came the holiday season. Our sales tripled overnight. The spreadsheet, once a trusted tool, became a source of pure chaos.

I spent an entire week in January just trying to reconcile our accounts. We had oversold products we didn’t have in stock, miscalculated shipping costs, and completely lost track of our profit margins on key items. It was a painful, expensive lesson. I was an operations manager, not a data entry clerk, and the business was suffering because I was stuck in the weeds.

We knew we needed a change. We chose QuickBooks Online because of its robust inventory management features and its ability to integrate directly with our e-commerce platform. The impact was profound.

- What I Appreciated (The Strengths):

- Automated Sales Data: Sales from our online store flowed directly into QuickBooks, automatically updating inventory levels and revenue figures. The manual data entry that had consumed my days was just… gone.

- Real-Time Inventory: We could see exactly what we had in stock at any moment, preventing overselling and improving our reordering process.

- Clear Profitability Metrics: The reporting tools allowed us to see our profit margin on every single product, which informed our marketing spend and pricing strategies.

- Scalability: We knew that as we grew, we could easily add payroll, manage contractors, and run more complex financial reports all within the same system.

- Where There Was Room for Growth (The Trade-offs):

- The Learning Curve: QuickBooks is powerful, but it’s not simple. There was a definite learning curve, and we had to spend time watching tutorials to get the hang of it.

- The Cost Factor: Unlike a free spreadsheet, it was a monthly expense. The price climbs as you add more features, so it’s a cost you need to budget for.

This experience taught me a critical lesson: the “best” affordable accounting software for startups is the one that solves your biggest operational headache. For our product-based business, inventory and e-commerce integration were everything. For a service-based agency or a SaaS company, the priorities would be entirely different.

The Platform Debate: Cloud Freedom vs. On-Premise Control

When you start exploring accounting software, you’ll encounter a fundamental choice: should your financial data live online in the cloud, or on your own computers with an on-premise solution? While one has become the clear favorite, understanding the distinction is key.

Cloud-Based Accounting Software: Your Financial HQ, Anywhere

Cloud-based accounting software operates on the vendor’s secure servers and is accessed through your web browser or a mobile app. This model, known as Software-as-a-Service (SaaS), is the default choice for modern startups because it’s built for flexibility and growth.

The market statistics tell a clear story. The cloud accounting sector is projected by researchers like Allied Market Research to grow significantly, indicating a massive shift toward this model. It’s not just a fad; it’s a better way for dynamic businesses to operate.

Key Advantages of the Cloud:

- Ultimate Flexibility: Manage your finances from anywhere you have an internet connection—your office, your home, or a coffee shop on the other side of the world.

- Set-It-and-Forget-It Maintenance: The provider handles all security updates, backups, and new feature rollouts automatically. You’re always on the latest and most secure version.

- Budget-Friendly Scaling: Subscription plans let you start small and add capabilities as your revenue and team grow. You avoid paying for enterprise-level features on day one.

- Effortless Collaboration: Securely invite your accountant or co-founder to access the books in real-time, eliminating the need to email sensitive files back and forth.

On-Premise Accounting Software: The Walled Garden Approach

On-premise accounting software is the classic model: you purchase a software license and install it on your local computer or server. This gives you a self-contained system that you own and control completely.

While less common for new ventures, this path can be necessary for startups in highly regulated industries like defense or healthcare, where data residency rules may prohibit the use of cloud servers.

Key Advantages of On-Premise:

- Total Data Control: Your financial data lives on your hardware, under your lock and key. You control access and security protocols entirely.

- Predictable Long-Term Cost: A one-time license fee can feel steep initially, but it can be more economical over a 5-10 year horizon compared to unending subscription fees.

- Offline Reliability: If your internet connection is unreliable, an on-premise solution ensures you can always access your financial data.

- Deeper Customization: These systems can sometimes be customized at a deeper level to integrate with highly specialized or legacy business systems.

Despite these points, the overwhelming benefits of accessibility, low upfront cost, and collaborative ease make cloud-based accounting software the right choice for nearly all startups.

The Top Contenders: Affordable Accounting Software for Startups

The market is crowded, but a few key players consistently rise to the top. Here’s a pragmatic look at the best options, helping you match the right tool to your startup’s specific needs.

1. Wave: The Best Option When Your Budget is Zero

For founders who are truly bootstrapping, Wave is a game-changer. It provides a powerful set of core accounting and invoicing tools for free, making it an incredible entry point into professional financial management.

- Who It’s For: Freelancers, solopreneurs, and brand-new startups watching every single penny.

- The Good Stuff:

- Truly Free Accounting: It’s a legitimate double-entry accounting system without a monthly fee.

- No Limits on the Basics: Send unlimited invoices and connect as many bank and credit card accounts as you need.

- Professional Invoicing: Create and send clean, customized invoices that make your small operation look polished.

- The Catches:

- Integration Desert: Wave connects with very few other business apps. As your tech stack grows, this becomes a major limitation.

- Lacks Deeper Automation: It doesn’t offer the sophisticated automation rules or project management features of its paid competitors.

- Payroll & Payments Cost Extra: Wave makes money on optional, fee-based services like payment processing and payroll.

2. Xero: The Design-Forward Collaborator

Xero is a top-tier QuickBooks competitor that wins hearts with its clean, intuitive design and collaboration-friendly features. It’s a robust piece of cloud-based accounting software that feels less like a chore and more like a modern tech tool.

- Who It’s For: Growing startups, especially those with a team, that value a great user experience and built-in collaborative tools.

- The Good Stuff:

- Unlimited Users: This is Xero’s killer feature. All plans allow for unlimited users, which offers huge savings for growing teams compared to per-user pricing models.

- User-Friendly Interface: Many founders find Xero’s navigation and workflow more logical and approachable than its competitors.

- Strong Core Functionality: It handles bank reconciliation, invoicing, bill pay, and even basic inventory with elegance.

- The Catches:

- Restrictive Starter Plan: The entry-level “Early” plan is very limited, capping you at 20 invoices and 5 bills per month, forcing most businesses to the next tier up.

- Support System: Customer support is primarily email-based, which can be slow when you have an urgent issue.

3. FreshBooks: The Service Business Champion

FreshBooks was built from the ground up for service-based businesses. Its entire feature set is optimized for tracking time, managing projects, and getting paid for your expertise.

- Who It’s For: Consultants, agencies, freelancers, and any startup whose primary product is its team’s time.

- The Good Stuff:

- Best-in-Class Invoicing: Incredibly easy to create beautiful, customized invoices with automated reminders and late-fee calculations.

- Seamless Time Tracking: The time-tracking tools are simple to use and integrate flawlessly into the invoicing workflow.

- Project Profitability Views: Easily track hours and expenses against project budgets to see which clients are truly profitable.

- The Catches:

- Not for Product Businesses: Its inventory management is an afterthought at best. If you sell physical goods, look elsewhere.

- Per-Client Limits on Low Tiers: The lower-priced plans limit the number of billable clients you can have, which can feel restrictive.

If you’re looking to explore more about affordable accounting software for startups , visit this websites 👇 which offer valuable resource s and up-to-date information for entrepreneurs. 👇

techbullion.in

mumbaitimes.net

mindjournal.co

ponta.in

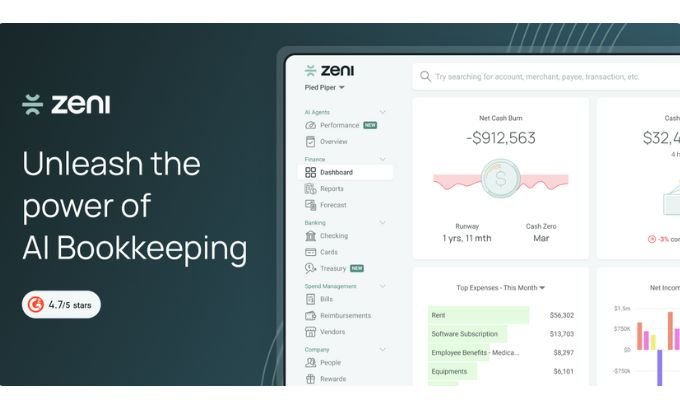

4. Zeni: The White-Glove Service for Funded Tech Startups

Zeni is in a different category. It isn’t just software; it’s a managed financial service. It pairs an AI-powered platform with a dedicated team of finance professionals, acting as an outsourced finance department for high-growth SaaS companies and tech startups.

- Who It’s For: Venture-backed startups that have moved beyond basic bookkeeping and need sophisticated financial management and reporting.

- The Good Stuff:

- Daily Bookkeeping: Your books are reconciled every single day, giving you a real-time financial dashboard.

- A Full Finance Team: The service includes bookkeepers, controllers, and fractional CFOs to provide strategic guidance.

- SaaS Metrics on Demand: The platform is built to track and visualize key metrics like MRR, ARR, churn, and LTV.

- The Catches:

- Premium Investment: This is a high-touch, premium service with a corresponding price tag. It is not affordable accounting software for startups in the traditional sense.

- Hands-Off Model: It’s designed for founders who want to delegate their finances, not for those who want to manage them directly.

At-a-Glance Comparison

| Software | Ideal Startup Profile | Starting Price (Approx.) | Killer Feature | Main Drawback |

|---|---|---|---|---|

| Wave | Bootstrapped & Solopreneurs | $0/month | Powerful core accounting is genuinely free. | Lacks integrations and advanced automation. |

| Xero | Collaborative Teams & Design Lovers | ~$15/month | Unlimited users on every plan. | Entry-level plan is too restrictive for most. |

| FreshBooks | Service-Based Businesses & Agencies | ~$17/month | Superb time tracking and invoicing workflow. | Not suitable for businesses selling products. |

| QuickBooks | E-commerce & Scalable Businesses | ~$30/month | Massive feature set and integration ecosystem. | Can feel complex; costs add up on higher tiers. |

| Zeni | Funded Tech & SaaS Companies | Custom (High-end) | Managed service with daily bookkeeping & experts. | Premium price; not a DIY software tool. |

Frequently Asked Questions (FAQ)

1. When is the absolute best time to start using accounting software?

The simple answer is day one. While it’s tempting to put it off, establishing a professional system from the beginning is far easier than trying to clean up and migrate months of chaotic spreadsheet data. Start as you mean to go on.

2. Can I really handle my startup’s accounting by myself?

Yes, especially in the beginning. Modern accounting software like Wave, FreshBooks, and Xero is designed specifically for business owners, not accountants. That said, it’s always smart to have a CPA review your books periodically.

3. What is “double-entry accounting,” and do I need it?

Double-entry is the global standard for business accounting. It means every financial transaction is recorded in at least two accounts (as a debit and a credit), ensuring your books are always balanced and accurate. All reputable software, including those listed here, uses this method.

4. Is free accounting software like Wave actually safe?

Yes. Reputable providers like Wave use bank-level 256-bit encryption to protect your data. They make money by offering paid services like payroll and payment processing, not by compromising your information.

5. How much should I budget for accounting software as a new startup?

You can start for $0. For a paid plan that offers more automation and scalability, a reasonable starting budget is $30-$70 per month. This cost will grow with your business as you need more advanced features or add more users.

6. I run a SaaS company. What’s the most important feature for me?

For SaaS Companies, the key is automated revenue recognition. You need a system that can handle subscription billing complexities and provide clear dashboards for crucial metrics like Monthly Recurring Revenue (MRR), churn, and Customer Acquisition Cost (CAC). Xero and QuickBooks can do this with app integrations, while Zeni is purpose-built for it.

7. Should I choose the software my accountant recommends?

It’s a great starting point, but not the only factor. Your accountant’s familiarity with a platform is important for collaboration, but you are the one using it every day. Choose the software that best fits your business workflow and that you find easiest to use. Most accountants are proficient in several major platforms.

Making Your Decision with Confidence

Choosing affordable accounting software for your startup is a strategic move that pays dividends in time, clarity, and peace of mind. It transforms your financial data from a historical record into a forward-looking guide for your business.

Don’t get stuck in analysis paralysis. The best path forward is to identify your one or two most critical needs—be it invoicing, inventory, or project tracking—and then sign up for a free trial of the top contenders. Get a feel for the platform. Run a few test transactions. The right tool will feel less like a burden and more like a powerful ally in your entrepreneurial journey.